Right to Receive a Good Faith Estimate of Expected Charges

You have the right to receive a “Good Faith Estimate” explaining how much your medical care will cost.

Under the law, health care providers need to give patients who don’t have insurance or are not using insurance an estimate of the bill for medical items and services.

You have the right to receive a Good Faith Estimate for the total expected cost of any non-emergency items or services. This includes

related costs like medical tests, prescription drugs, equipment, and hospital fees.

You can read the full statute below:

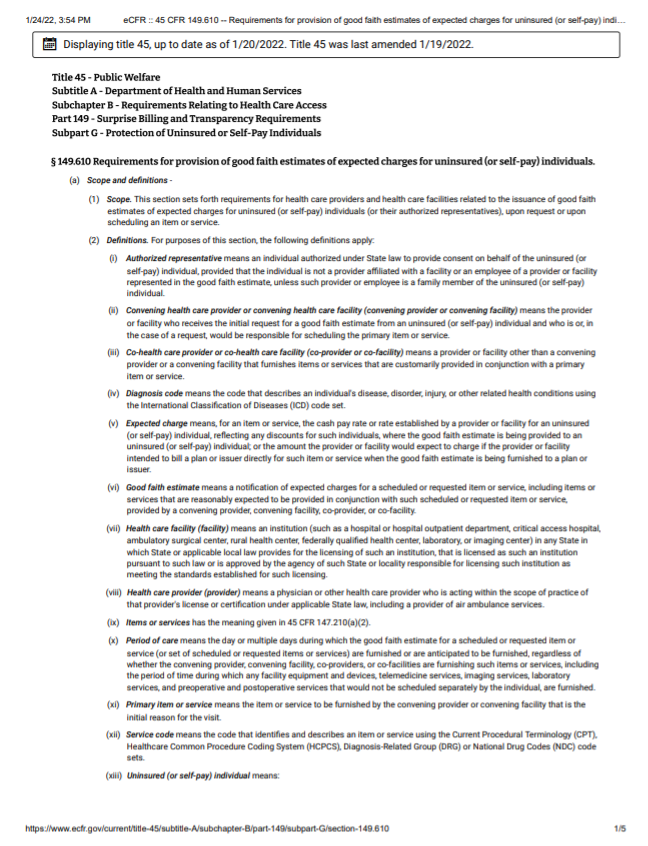

§ 149.610 Requirements for provision of good faith estimates of expected charges for uninsured (or self-pay) individuals.

(a) Scope and definitions –

(1) Scope. This section sets forth requirements for health care providers and health care facilities related to the issuance of good faith estimates of expected charges for uninsured (or self-pay) individuals (or their authorized representatives), upon request or upon scheduling an item or service.

(2) Definitions. For purposes of this section, the following definitions apply:

(i) Authorized representative means an individual authorized under State law to provide consent on behalf of the uninsured (or self-pay) individual, provided that the individual is not a provider affiliated with a facility or an employee of a provider or facility represented in the good faith estimate, unless such provider or employee is a family member of the uninsured (or self-pay) individual.

(ii) Convening health care provider or convening health care facility (convening provider or convening facility) means the provider or facility who receives the initial request for a good faith estimate from an uninsured (or self-pay) individual and who is or, in the case of a request, would be responsible for scheduling the primary item or service.

(iii) Co-health care provider or co-health care facility (co-provider or co-facility) means a provider or facility other than a convening provider or a convening facility that furnishes items or services that are customarily provided in conjunction with a primary item or service.

(iv) Diagnosis code means the code that describes an individual’s disease, disorder, injury, or other related health conditions using the International Classification of Diseases (ICD) code set.

(v) Expected charge means, for an item or service, the cash pay rate or rate established by a provider or facility for an uninsured (or self-pay) individual, reflecting any discounts for such individuals, where the good faith estimate is being provided to an uninsured (or self-pay) individual; or the amount the provider or facility would expect to charge if the provider or facility intended to bill a plan or issuer directly for such item or service when the good faith estimate is being furnished to a plan or issuer.

(vi) Good faith estimate means a notification of expected charges for a scheduled or requested item or service, including items or services that are reasonably expected to be provided in conjunction with such scheduled or requested item or service, provided by a convening provider, convening facility, co-provider, or co-facility.

(vii) Health care facility (facility) means an institution (such as a hospital or hospital outpatient department, critical access hospital, ambulatory surgical center, rural health center, federally qualified health center, laboratory, or imaging center) in any State in which State or applicable local law provides for the licensing of such an institution, that is licensed as such an institution pursuant to such law or is approved by the agency of such State or locality responsible for licensing such institution as meeting the standards established for such licensing.

(viii) Health care provider (provider) means a physician or other health care provider who is acting within the scope of practice of that provider’s license or certification under applicable State law, including a provider of air ambulance services.

(ix) Items or services has the meaning given in 45 CFR 147.210(a)(2).

(x) Period of care means the day or multiple days during which the good faith estimate for a scheduled or requested item or service (or set of scheduled or requested items or services) are furnished or are anticipated to be furnished, regardless of whether the convening provider, convening facility, co-providers, or co-facilities are furnishing such items or services, including the period of time during which any facility equipment and devices, telemedicine services, imaging services, laboratory services, and preoperative and postoperative services that would not be scheduled separately by the individual, are furnished.

(xi) Primary item or service means the item or service to be furnished by the convening provider or convening facility that is the initial reason for the visit.

(xii) Service code means the code that identifies and describes an item or service using the Current Procedural Terminology (CPT), Healthcare Common Procedure Coding System (HCPCS), Diagnosis-Related Group (DRG) or National Drug Codes (NDC) code sets.

(xiii) Uninsured (or self-pay) individual means:

(A) An individual who does not have benefits for an item or service under a group health plan, group or individual health insurance coverage offered by a health insurance issuer, Federal health care program (as defined in section 1128B(f) of the Social Security Act), or a health benefits plan under chapter 89 of title 5, United States Code; or

(B) An individual who has benefits for such item or service under a group health plan, or individual or group health insurance coverage offered by a health insurance issuer, or a health benefits plan under chapter 89 of title 5, United States Code but who does not seek to have a claim for such item or service submitted to such plan or coverage.

(b) Requirements of providers and facilities –

(1) Requirements for convening providers and convening facilities. A convening provider or convening facility must determine if an individual is an uninsured (or self-pay) individual by:

(i) Inquiring if an individual is enrolled in a group health plan, group or individual health insurance coverage offered by a health insurance issuer, Federal health care program (as defined in section 1128B(f) of the Social Security Act), or a health benefits plan under chapter 89 of title 5, United States Code;

(ii) Inquiring whether an individual who is enrolled in a group health plan, or group or individual health insurance coverage offered by a health insurance issuer or a health benefits plan under chapter 89 of title 5, United States Code is seeking to have a claim submitted for the primary item or service with such plan or coverage; and

(iii) Informing all uninsured (or self-pay) individuals of the availability of a good faith estimate of expected charges upon scheduling an item or service or upon request; information regarding the availability of good faith estimates for uninsured (or self-pay) individuals must be:

(A) Written in a clear and understandable manner, prominently displayed (and easily searchable from a public search engine) on the convening provider’s or convening facility’s website, in the office, and on-site where scheduling or questions about the cost of items or services occur;

(B) Orally provided when scheduling an item or service or when questions about the cost of items or services occur; and

(C) Made available in accessible formats, and in the language(s) spoken by individual(s) considering or scheduling items or services with such convening provider or convening facility.

(iv) Convening providers and convening facilities shall consider any discussion or inquiry regarding the potential costs of items or services under consideration as a request for a good faith estimate;

(v) Upon the request for a good faith estimate from an uninsured (or self-pay) individual or upon scheduling a primary item or service to be furnished for such an individual, the convening provider or convening facility must contact, no later than 1 business day of such scheduling or such request, all co-providers and co-facilities who are reasonably expected to provide items or services in conjunction with and in support of the primary item or service and request that the co-providers or co-facilities submit good faith estimate information (as specified in paragraphs (b)(2) and (c)(2) of this section) to the convening provider or facility; the request must also include the date that good faith estimate information must be received by the convening provider or facility;

(vi) Provide a good faith estimate (as specified in paragraph (c)(1) of this section) to uninsured (or self-pay) individuals within the following timeframes:

(A) When a primary item or service is scheduled at least 3 business days before the date the item or service is scheduled to be furnished: Not later than 1 business day after the date of scheduling;

(B) When a primary item or service is scheduled at least 10 business days before such item or service is scheduled to be furnished: Not later than 3 business days after the date of scheduling; or

(C) When a good faith estimate is requested by an uninsured (or self-pay) individual: Not later than 3 business days after the date of the request.

(vii) A convening provider or convening facility must provide an uninsured (or self-pay) individual who has scheduled an item or service with a new good faith estimate if a convening provider, convening facility, co-provider, or co-facility anticipates or is notified of any changes to the scope of a good faith estimate (such as anticipated changes to the expected charges, items, services, frequency, recurrences, duration, providers, or facilities) previously furnished at the time of scheduling; a new good faith estimate must be issued to the uninsured (or self-pay) individual no later than 1 business day before the items or services are scheduled to be furnished.

(viii) If any changes in expected providers or facilities represented in a good faith estimate occur less than 1 business day before the item or service is scheduled to be furnished, the replacement provider or facility must accept as its good faith estimate of expected charges the good faith estimate for the relevant items or services included in the good faith estimate for the items or services being furnished that was provided by the replaced provider or facility.

(ix) For good faith estimates provided upon request of an uninsured (or self-pay) individual, upon scheduling of the requested item or service, the convening provider or convening facility must provide the uninsured (or self-pay) individual with a new good faith estimate for the scheduled item or service within the timeframes specified in paragraphs (b)(1)(vi)(A) and (B) of this section; and

(x) A convening provider or convening facility may issue a single good faith estimate for recurring primary items or services if the following requirements are met, in addition to the requirements under this section:

(A) The good faith estimate for recurring items or services must include, in a clear and understandable manner, the expected scope of the recurring primary items or services (such as timeframes, frequency, and total number of recurring items or services); and

(B) The scope of a good faith estimate for recurring primary items or services must not exceed 12 months. If additional recurrences of furnishing such items or services are expected beyond 12 months (or as specified under paragraph (b)(vii) of this section), a convening provider or convening facility must provide an uninsured (or self-pay) individual with a new good faith estimate, and communicate such changes (such as timeframes, frequency, and total number of recurring items or services) upon delivery of the new good faith estimate to help patients understand what has changed between the initial good faith estimate and the new good faith estimate.

(2) Requirements for co-providers and co-facilities.

(i) Co-providers and co-facilities must submit good faith estimate information (as specified in paragraph (c)(2) of this section) upon the request of the convening provider or convening facility. The co-provider or co-facility must provide, and the convening provider or convening facility must receive, the good faith estimate information no later than 1 business day after the co-provider or co-facility receives the request from the convening provider or convening facility.

(ii) Co-providers and co-facilities must notify and provide new good faith estimate information to a convening provider or convening facility if the co-provider or co-facility anticipates any changes to the scope of good faith estimate information previously submitted to a convening provider or convening facility (such as anticipated changes to the expected charges, items, services, frequency, recurrences, duration, providers, or facilities).

(iii) If any changes in the expected co-providers or co-facilities represented in a good faith estimate occur less than 1 business day before that the item or service is scheduled to be furnished, the replacement co-provider or co-facility must accept as its good faith estimate of expected charges the good faith estimate for the relevant items or services included in the good faith estimate for the item or service being furnished that was provided by the replaced provider or facility.

(iv) In the event that an uninsured (or self-pay) individual separately schedules or requests a good faith estimate from a provider or facility that would otherwise be a co-provider or co-facility, that provider or facility is considered a convening provider or convening facility for such item or service and must meet all requirements in paragraphs (b)(1) and (c)(1) of this section for issuing a good faith estimate to an uninsured (or self-pay) individual.

(c) Content requirements of a good faith estimate issued to an uninsured (or self-pay) individual.

(1) A good faith estimate issued to an uninsured (or self-pay) individual must include:

(i) Patient name and date of birth;

(ii) Description of the primary item or service in clear and understandable language (and if applicable, the date the primary item or service is scheduled);

(iii) Itemized list of items or services, grouped by each provider or facility, reasonably expected to be furnished for the primary item or service, and items or services reasonably expected to be furnished in conjunction with the primary item or service, for that period of care including:

(A) Items or services reasonably expected to be furnished by the convening provider or convening facility for the period of care; and

(B) Items or services reasonably expected to be furnished by co-providers or co-facilities (as specified in paragraphs (b)(2) and (c)(2) of this section);

(iv) Applicable diagnosis codes, expected service codes, and expected charges associated with each listed item or service;

(v) Name, National Provider Identifier, and Tax Identification Number of each provider or facility represented in the good faith estimate, and the State(s) and office or facility location(s) where the items or services are expected to be furnished by such provider or facility;

(vi) List of items or services that the convening provider or convening facility anticipates will require separate scheduling and that are expected to occur before or following the expected period of care for the primary item or service. The good faith estimate must include a disclaimer directly above this list that includes the following information: Separate good faith estimates will be issued to an uninsured (or self-pay) individual upon scheduling or upon request of the listed items or services; notification that for items or services included in this list, information such as diagnosis codes, service codes, expected charges and provider or facility identifiers do not need to be included as that information will be provided in separate good faith estimates upon scheduling or upon request of such items or services; and include instructions for how an uninsured (or self-pay) individual can obtain good faith estimates for such items or services;

(vii) [Reserved]

(viii) A disclaimer that informs the uninsured (or self-pay) individual that there may be additional items or services the convening provider or convening facility recommends as part of the course of care that must be scheduled or requested separately and are not reflected in the good faith estimate;

(ix) A disclaimer that informs the uninsured (or self-pay) individual that the information provided in the good faith estimate is only an estimate regarding items or services reasonably expected to be furnished at the time the good faith estimate is issued to the uninsured (or self-pay) individual and that actual items, services, or charges may differ from the good faith estimate; and

(x) A disclaimer that informs the uninsured (or self-pay) individual of the uninsured (or self-pay) individual’s right to initiate the patient-provider dispute resolution process if the actual billed charges are substantially in excess of the expected charges included in the good faith estimate, as specified in § 149.620; this disclaimer must include instructions for where an uninsured (or self-pay) individual can find information about how to initiate the patient-provider dispute resolution process and state that the initiation of the patient-provider dispute resolution process will not adversely affect the quality of health care services furnished to an uninsured (or self-pay) individual by a provider or facility; and

(xi) A disclaimer that the good faith estimate is not a contract and does not require the uninsured (or self-pay) individual to obtain the items or services from any of the providers or facilities identified in the good faith estimate.

(2) [Reserved]

(d) Content Requirements for Good Faith Estimate Information Submitted by Co-Providers or Co-Facilities to Convening Providers or Convening Facilities.

(1) Good faith estimate information submitted to convening providers or convening facilities by co-providers or co-facilities for inclusion in the good faith estimate (described in paragraph (c)(1) of this section) must include:

(i) Patient name and date of birth;

(ii) Itemized list of items or services expected to be provided by the co-provider or co-facility that are reasonably expected to be furnished in conjunction with the primary item or service as part of the period of care;

(iii) Applicable diagnosis codes, expected service codes, and expected charges associated with each listed item or service;

(iv) Name, National Provider Identifiers, and Tax Identification Numbers of the co-provider or co-facility, and the State(s) and office or facility location(s) where the items or services are expected to be furnished by the co-provider or co-facility; and

(v) A disclaimer that the good faith estimate is not a contract and does not require the uninsured (or self-pay) individual to obtain the items or services from any of the co-providers or co-facilities identified in the good faith estimate.

(2) [Reserved]

(e) Required Methods for Providing Good Faith Estimates for Uninsured (or Self-Pay) Individuals.

(1) A good faith estimate must be provided in written form either on paper or electronically, pursuant to the uninsured (or self-pay) individual’s requested method of delivery, and within the timeframes described in paragraph (b) of this section. Good faith estimates provided electronically must be provided in a manner that the uninsured (or self-pay) individual can both save and print. A good faith estimate must be provided and written using clear and understandable language and in a manner calculated to be understood by the average uninsured (or self-pay) individual.

(2) To the extent that an uninsured (or self-pay) individual requests a good faith estimate in a method other than paper or electronically (for example, by phone or orally in person), the convening provider may orally inform the uninsured (or self-pay) individual of information contained in the good faith estimate using the method requested by the uninsured (or self-pay) individual; however, in order for a convening provider or convening facility to meet the requirements of this section, the convening provider or convening facility must issue the good faith estimate to the uninsured (or self-pay) individual in written form as specified in paragraph (e)(1) of this section.

(f) Additional compliance provisions.

(1) A good faith estimate issued to uninsured (or self-pay) individual under this section is considered part of the patient’s medical record and must be maintained in the same manner as a patient’s medical record. Convening providers and convening facilities must provide a copy of any previously issued good faith estimate furnished within the last 6 years to an uninsured (or self-pay) individual upon the request of the uninsured (or self-pay) individual.

(2) Providers or facilities that issue good faith estimates issued under State processes that do not meet the requirements set forth in this section fail to comply with the requirements of this section.

(3) A provider or facility will not fail to comply with this section solely because, despite acting in good faith and with reasonable due diligence, the provider or facility makes an error or omission in a good faith estimate required under this section, provided that the provider or facility corrects the information as soon as practicable. If items or services are furnished before an error in a good faith estimate is addressed, the provider or facility may be subject to patient-provider dispute resolution if the actual billed charges are substantially in excess of the good faith estimate (as described in § 149.620).

(4) To the extent compliance with this section requires a provider or facility to obtain information from any other entity or individual, the provider or facility will not fail to comply with this section if it relied in good faith on the information from the other entity, unless the provider or facility knows, or reasonably should have known, that the information is incomplete or inaccurate. If the provider or facility learns that the information is incomplete or inaccurate, the provider or facility must provide corrected information to the uninsured (or self-pay) individual as soon as practicable. If items or services are furnished before an error in a good faith estimate is addressed, the provider or facility may be subject to patient-provider dispute resolution if the actual billed charges are substantially in excess of the good faith estimate (as described in § 149.620).

(g) Applicability –

(1) Applicability date. The requirements of this section are applicable for good faith estimates requested on or after January 1, 2022 or for good faith estimates required to be provided in connection with items or services scheduled on or after January 1, 2022.

(2) Applicability with other laws. Nothing in this section alters or otherwise affects a provider’s or facility’s requirement to comply with other applicable State or Federal laws, including those governing the accessibility, privacy, or security of information required to be disclosed under this section, or those governing the ability of properly authorized representatives to access uninsured (or self-pay) individuals’ information held by providers or facilities, except to the extent a state law prevents the application of this section.